If you work part-time, are self-employed, it can be hard to keep track of your income on a regular basis when it comes time to fill out forms and applications, such as credit card applications, apartment lease agreements, or applying for insurance.

Luckily, there are plenty of free or inexpensive options available to make keeping track of your income easier than ever before—and in some cases it can even be automated!

However, there are plenty of situations where it’s required that you provide proof of income.

In addition to paying your bills on time, these 5 situations will require you to show proof of income from the IRS or from your employer—and the consequences if you don’t will be costly in both time and money.

Buying Your Home

Before you can close on a house, a lender must verify your income and credit.

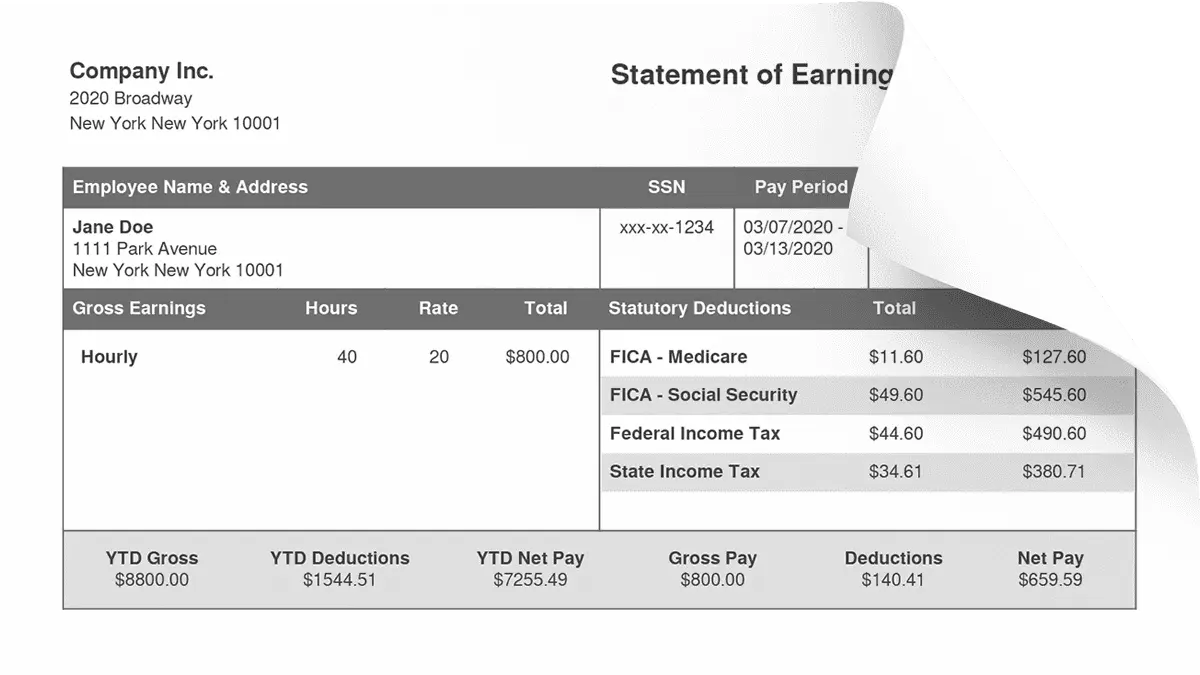

Lenders need one of two documents to prove that you have steady income: your tax return or a pay stub.

If you’re an independent contractor, you might need both. If you’re buying with someone else, each person must provide proof of income.

To ensure a smooth process when buying your home, pull together all necessary paperwork before visiting a mortgage lender for approval.

Having everything in order will also save you time once you’ve made an offer.

When buying a car, auto lenders also want to see proof of income—usually as recent as possible—and some require it even if you don’t qualify for financing through them.

It helps if your pay stubs show enough regular income from your job so that lenders know they can rely on your ability to make payments.

Applying For A Loan

When you’re applying for a loan, whether it’s a car loan or home equity line of credit, lenders need proof that you can afford whatever you’re asking them for.

They want to know your credit score, debt-to-income ratio and details about your previous history with finances.

The more information you have on hand, the better off you are when it comes time to apply for a loan.

For example, if you plan on buying a house in two years but don’t yet have any savings set aside, consider putting some money into an emergency fund before submitting an application.

This way, if something goes wrong during negotiations- and there’s always a chance it will – you won’t be left scrambling to cover bills.

Having all of your financial ducks in a row is essential for getting approved for a loan, as well as getting one at a good interest rate.

And if you do get denied? It’s not necessarily time to give up; simply gather up new information and try again.

Applying For Car Insurance

If you have ever shopped for car insurance, you’ve probably noticed that quotes change depending on what type of policy you apply for.

Before you sign a contract and pay for your first premium, find out if it’s even necessary to show proof of income in order to get a certain type of policy.

For example, some carriers will offer discounts or lower rates if you bring in at least two years’ worth of tax returns or pay stubs when applying for a policy.

If so, go ahead and start generating pay stubs using a pay stub generator.

Then, simply print them off and present them to your agent as soon as possible.

And remember: not all policies are created equal; shop around before making any final decisions!

Don’t forget—the list of situations where you may need to provide proof of income goes beyond just car insurance applications.

Other examples include rental applications, mortgage applications and credit card applications (along with other loan applications).

With every application that requires pay stubs or tax returns as part of its documents checklist, an accurate pay stub generator can help you save time and money!

Moving From One Country To Another

One of the first questions that people moving from one country to another often get asked is How much do you make?

It may seem like a silly question, but for companies, it’s extremely important.

Those moving internationally will need a pay stub generator, or sometimes proof of income.

As someone new to living abroad, it can be difficult and stressful learning how things work in your new environment.

The best thing you can do is take an open-minded approach and learn as much as possible about your new home before jumping into anything too quickly.

Once you’ve had time to settle in, consider looking into jobs with biweekly pay so that you don’t feel overwhelmed by large bills at once.

There are plenty of resources online for those who are interested in finding jobs abroad; just keep an eye out for scams!

Be wary of anyone asking for money up front, no matter how legitimate they might sound.

Pay stub generators usually cost anywhere between $10-$30 USD per month and offer everything you could possibly need during your transition period.

Starting A New Job

New employees are often required to prove their income with pay stubs or W-2 statements before they can start work, especially when they’re hired on a contract or freelance basis.

In some cases, new hires will be asked for proof even if they’re hired as full-time employees. If you think you might need to provide your income information at any point in your career.

The tool lets you easily create printable pay stubs that show all of your relevant information—including taxes withheld and Social Security contributions—in a format that matches what employers expect.

It also allows you to make multiple copies of each stub so that you have them ready for future jobs.

Since most jobs don’t require monthly payroll reports, we recommend using Paystubsnow’s biweekly pay option so that you only have to generate one report every two weeks instead of one every month.